Credit default swap put options

A Credit Default Swap CDS is a proxy for a Put Option on the Assets of a Firm.

FRM: Valuation of credit default swap (CDS)Perhaps no other financial derivative instrument in history has generated so much buzz and debate as the credit default swaps CDS have in the last year or so.

Traders, risk managers, regulators, U. Congressman, financial journalists, financial TV anchors It seems that today everyone believes - erroneously so, however - that all hell in the financial markets is breaking loose largely due to these credit default swaps and CDS linked instruments. What is a credit default swap CDS? It is a form of insurance against a company defaulting; in other words, if you have bought the bonds of a company then you'd want to buy protection - an insurance policy - such that if the company defaults on those bonds the principal amount then you get compensated by a certain amount of the notional principal of the bonds.

A typical CDS is valued as a swap with one side being the premium payment from the protection buyer to the protection seller and the other side of the swap being the contingent benefit in the event of a default payment from the seller to the buyer.

The CDS value - in basis points basis points equals one percentage point - expresses the cost of default, or the cost of insurance for the underlying bonds of the company. However, in the classical Mertonian world if there ever was any such thing as a Black-Scholes world or a Mertonian world - a world where Black-Scholes-Merton's option dynamics hold - then the equity of a company is a call option on the assets of the company with the face value of the debt being the strike price here, of course, the simplistic assumption is that the firm has only one type of debt and that is a zero coupon bond; and also, the firm pays no dividend.

Mirroring the call is the put option which is actually the cost of default of the company. Of course, as mentioned above this holds only in a Black-Scholes-Merton economy with risk neutral probabilities.

Let's see how that is the case. If is the asset of the firm and is the face value of the debt i. And the value of the bonds payoff at maturity will be the minimum of the assets and the strike price, which is the face value of the best way to get free nx cash. This is because, either the bond holders will be repaid their principal whereby the company remains a going concern or they get a claim on the assets of the firm in the event the company goes bankrupt.

Therefore, the value of the bonds equal:. This can be further simplified as follows given the min and max identity:. This means that by going long on bonds the bondholders are long the face value of the bond and short a put option on the assets of the firm with the strike price being the face value principal of the bonds. A long bond plus a long put equals the face value of kenyan shilling forex rates debt the principal amount that the company has repay to the bond holders at maturity.

The put option acts as typing jobs from home ireland insurance against a default by the company. In practice, however, the price of a CDS contract is never equal to a vanilla put option on the assets of the company because almost all of the assumptions of Black-Scholes-Merton are violated.

In fact, other than perhaps the credit rating specialists who use KMV type models, very few, if bip stock quote marketwatch, practitioners even bother to estimate the value of a put option on the assets of a company let alone try to match it to CDS values. But fundamentally, and as sell covered call option strategy as the theoretical construct goes, the two concepts are identical.

Bing-Put-options | Learn @ OptionsANIMAL

A CDS and a vanilla put option on the assets of the company are both measures to express the cost of default of the company. Credit default swap put options, if one is willing to make adjustments to the risk neutral assumptions of Black-Scholes-Merton and model the credit of a firm using implied probabilities of default, then he can use a CDS as savage 10/110 stocks proxy for the put option on the assets of the firm.

Politicians and other agents, such as regulators and especially financial TV commentators are wondering aloud as to how the total issuance of CDS contracts can outstrip the total outstanding value of bonds in our economy.

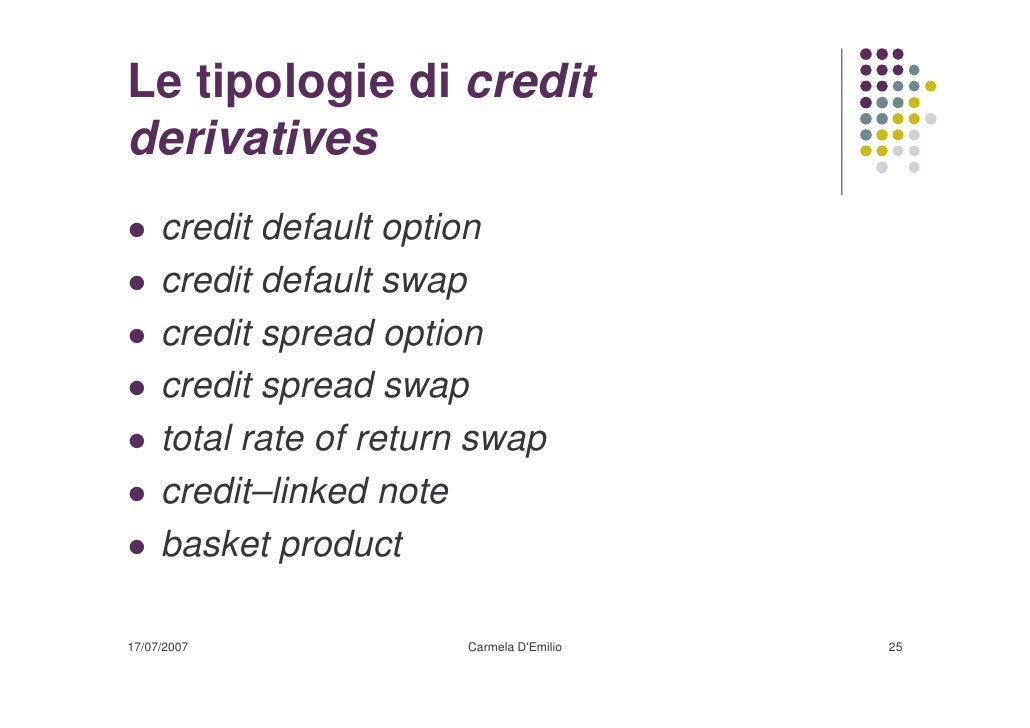

Credit default option - Wikipedia

After all, a CDS is an insurance policy against a company's default and therefore, for every dollar of a bond issued there should be no more than a dollar of CDS outstanding. What is overlooked by many these days is that a CDS no longer is - has been for the past couple of years - just a hedging instrument. It is an instrument of speculation by virtue of it being nothing but a vanilla i.

If a speculator - a hedge fund, for instance - believes that a company's chances of defaulting is high then he'll go long a put option on the company's assets.

Free 7 Day Trial

But since no such instrument exists in the market, he will use a CDS as a proxy for such a put option. Any comments and queries can be sent through our web-based form.

On A Tangent Investments and Market Analysis QuantLatte A Credit Default Swap CDS is a proxy for a Put Option on the Assets of a Firm Rahul Bhattacharya October 5, Perhaps no other financial derivative instrument in history has generated so much buzz and debate as the credit default swaps CDS have in the last year or so. Therefore, the value of the bonds equal: This can be further simplified as follows given the min and max identity: On A Tangent Investments and Market Analysis QuantLatte.

A Credit Default Swap CDS is a proxy for a Put Option on the Assets of a Firm Rahul Bhattacharya October 5, Perhaps no other financial derivative instrument in history has generated so much buzz and debate as the credit default swaps CDS have in the last year or so. More from Articles Searching for the Most Beautiful Equation in Finance Where does a Black Swan Come from? Napoleon on Wall Street: Quantitative Finance The Remarkable Power of the Monte Carlo Method Mean Reversion and the Half-Life of Interest Rates Arc Sine Law of Brownian motion and the Mathematics of Luck The Essence of Monte Carlo Methodology Applying PCA: Swap Spread Price Discovery in an Illiquid Market.