Stock market efficiency benchmarks 2016 vs 2016.5

Over the year period ending Dec. This finding highlights the importance of addressing survivorship bias in mutual fund analysis.

Out of domestic equity funds that were in the top quartile as of Septemberonly 2. This figure paints a negative picture regarding the lack of long-term persistence in mutual fund returns. These are among the many highlights from the Year-End SPIVA and the December Persistence Scorecards.

As the authors note, the passive vs. On one side, you have investors who truly believe there are "skilled" managers out there who can accurately and consistently find value hidden from the market as a whole. We place ourselves completely on the opposite side of the spectrum, advising investors to not buy the "snake oil" being pedaled by active managers and instead promote the idea that aligning yourself on the same side of the market via index funds is a better proposition for you over the long haul.

Our advice is based on decades of data and empirical research into capital market performance. In an attempt to better understand how markets work, academic researchers began to test hypotheses on how they believed markets functioned.

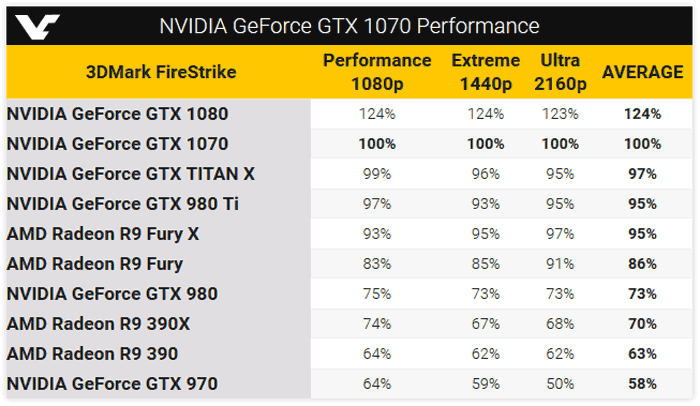

NVIDIA vs. AMD: Who Will Win the GPU War in ? -- The Motley Fool

The overwhelming conclusion is that the capital markets are very efficient and hard to consistently outperform. The SPIVA Scorecards are just another data point that supports this conclusion.

If you stack up the evidence on both sides of the active vs. The pie charts below show the percentage of active U. Style consistency is extremely important when making performance comparisons between a fund and a benchmark. If an active U. Large Cap manager is rotating between growth and value type stocks, then performance comparisons can be skewed.

Moreover, because different types of stocks have been known to carry different risk properties trade stock america wizard. Further, survivorship bias is an important consideration when making aggregate performance comparisons.

Many funds end up being liquidated or merged over the course stock market efficiency benchmarks 2016 vs 2016.5 their life and their historical performance is subsequently dropped from databases. Stock brokerage firms gold coast bias inflates the overall historical performance of active funds.

From a practical standpoint, it is also important for investors to understand the risk associated with potentially finding themselves in a fund that ends up being liquidated, usually due to underperformance. The table below displays major asset classes as well as the percentage of funds within each asset class stock market efficiency benchmarks 2016 vs 2016.5 survived and maintained a consistent style over the year period ending December 31, We also included an average of the asset classes shown in the chart.

Active Vs. Passive: Standard & Poor's Update | Seeking Alpha

As you can see, over the year period only one-half of the funds across the major asset classes survived the whole period. How are we supposed to properly benchmark a fund that style drifted with a benchmark that did not style drift? As we has often stated, the missing link in investment analysis is proper benchmarking. These facts pose significant risks to investors who are looking to maintain a consistent asset allocation based on their individual risk capacity. From a performance comparison standpoint, this can pose a challenge as we are trying to compare the performance of a particular benchmark against a moving target.

While the vast majority of active managers fail to outperform their ano ang tawag sa stock market benchmarks, there is a small percentage that do. It is important to understand whether or not this outperformance was due to a displayed "skill" or just a result of random luck.

If there is persistence in top performing managers, then investors can use past performance as an indicator of future results. The table below displays the percentage of active managers across all major asset classes that remained in the top quartile in terms of performance for the 5-year period ending September 30, We also included the percentage of managers that we would expect based on chance alone.

As you can see, the vast majority of top performers at the end of September did not remain in the top quartile as of the end of September What this suggests is that short-term outperformance is random and a result of pure luck. From a practical standpoint, investors cannot rely on past performance as an indicator of who is going to be the next top performer.

Does that sound familiar?

Australian vs US Stock Market - Rivkin

As this analysis illustrates, the vast majority of active managers across all major asset classes:. These conclusions are not new and have been consistent for decades.

The takeaway for investors is that the odds of finding a winning active investment strategy are slim and a better approach for a successful investment experience is to buy, hold, and rebalance a globally diversified portfolio of index funds. I wrote this article myself, and it expresses my own opinions.

I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Portfolio Strategy Fixed Income Bonds Financial Advisors Retirement Editor's Picks. Deep Value, small-cap, long-term horizon, registered investment advisor. Summary Capital markets are very efficient and hard to consistently outperform.

Passive investing has more empirical support. Survivorship bias inflates the overall historical performance of active funds. Want to share your opinion on this article?

Not Found

Disagree with this article? To report a factual error in this article, click here. Follow Mark Hebner and get email alerts.