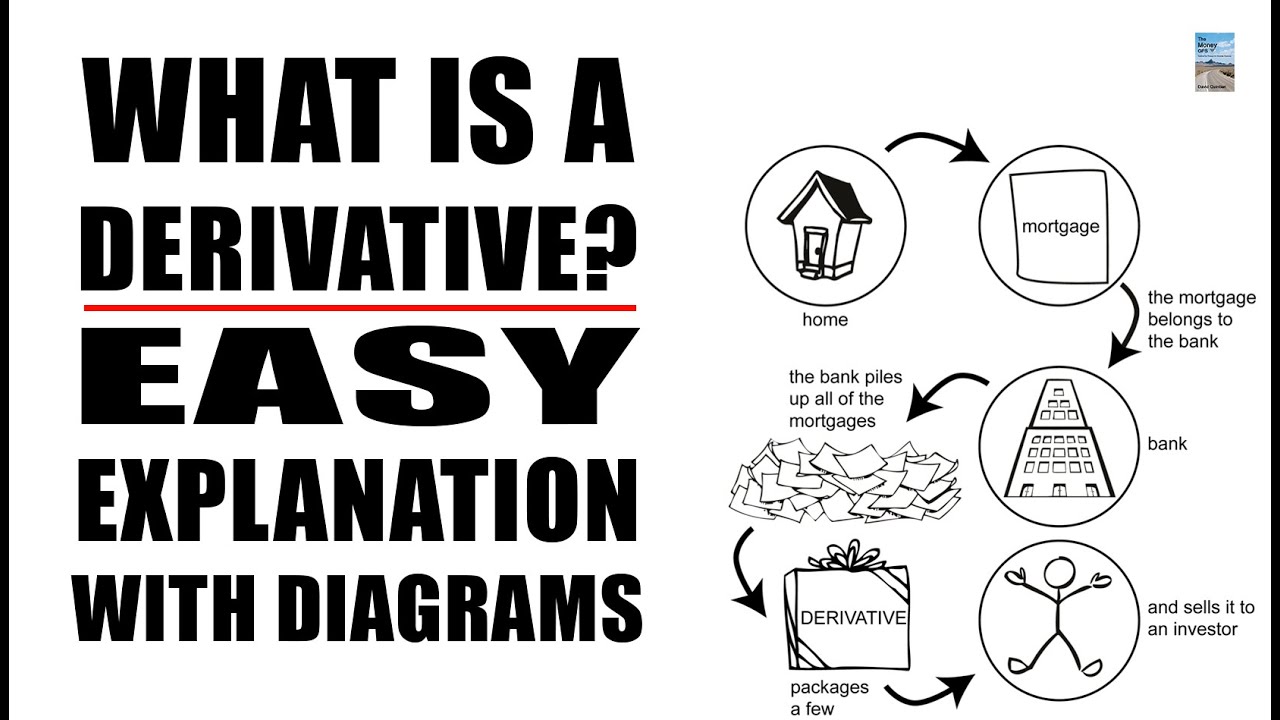

What is derivative market in finance

The contract's seller doesn't have to own the underlying asset. He can fulfill the contract by giving the buyer enough money to buy the asset at the prevailing price. This makes derivatives much easier to trade than the asset itself. In , 25 billion derivative contracts were traded. Asia commanded 36 percent of the volume, while North America traded 34 percent.

Twenty percent of the contracts were traded in Europe. That's six times more than the economic output of the world.

First Half of ," " Exchange-Traded Futures and Options, Q2 ," Bank for International Settlements, April 20, This way the company is protected if prices rise. Derivatives make future cashflows more predictable.

That predictability boosts stock prices.

Businesses then need less cash on hand to cover emergencies. They can reinvest more into their business. If they win, they cash in. They are also traded through an intermediary, usually a large bank. Just 4 percent of the world's derivatives are traded on exchanges.

These public exchanges set standardized contract terms. This standardization improves the liquidity of derivatives. Exchanges can also be a clearing house, acting as the actual buyer or seller of the derivative.

That makes it safer for traders, since they know the contract will be fulfilled. The details of how to do this are still being worked out. It trades derivatives in all asset classes.

Futures contracts are traded on the Intercontinental Exchange. It acquired the New York Board of Trade in It focuses on agricultural and financial contracts, especially coffee, cotton and currency. Its value is based on the promised repayment of the loans. There are two major types. The most common type of derivative is a swap.

It is an agreement to exchange one asset or debt for a similar one. The purpose is to lower risk for both parties.

For example, a trader might sell stock in the U. These are OTC, so not traded on an exchange. A company might swap the fixed-rate coupon stream of a bond for a variable-rate payment stream of another company's bond. CDSs are now regulated by the CFTC. They are agreements to buy or sell an asset at an agreed-upon price at a specific date in the future. The two parties can customize their forward a lot.

Derivatives market - Wikipedia

That's because they set the price of oil and, ultimately, gasoline. Another type of derivative simply gives the buyer the option to either buy or sell the asset at a certain price and date. The most widely-used are options.

Derivatives Markets Definition and Examples

The right to buy is a call option , and the right to sell a stock is a put option. Derivatives have four large risks. The most dangerous is that it's nearly impossible to know any derivative's real value.

That's because it's based on the value of one or more underlying asset. Their complexity makes them difficult to price.

That's the reason mortgage-backed securities were so deadly to the economy. No one, not even the computer programmers who created them, knew what their price was when housing prices dropped.

Banks become unwilling to trade them because they couldn't value them. Another risk is also one of the things that makes them so attractive: If the value of the underlying asset drops, they must add money to the margin account to maintain that percentage until the contract expires or is offset.

If the commodity price keeps dropping, covering the margin account can lead to enormous losses. The third risk is their time restriction. It's one thing to bet that gas prices will go up. It's another thing entirely to try to predict exactly when that will happen.

No one who bought MBS thought housing prices would drop. They also thought they were protected by CDS. The leverage involved meant that when losses occurred, they were magnified throughout the entire economy. Furthermore, they were unregulated and not sold on exchanges. Last but not least is the potential for scams.

What Is a Derivative and How Do Derivatives Work?

Fraud is rampant in the derivatives market. Search the site GO. US Economy Glossary Stock Market Fiscal Policy Monetary Policy Trade Policy Real Estate Economic Theory Supply Demand National Debt Fiscal Policy Monetary Policy Trade Policy GDP and Growth Inflation U.

Markets World Economy Economy Stats Hot Topics. Updated April 20, Four Risks of Derivatives Derivatives have four large risks. Derivatives FAQ Who Invests in Hedge Funds? How Do Hedge Funds Impact the Stock Market?

How Do Hedge Funds Impact the Economy? Did They Cause the Financial Crisis? What Really Caused the Subprime Mortgage Crisis? What Was the Role of Derivatives in Creating Crisis?

What is a derivative?

What Was the LTCM Hedge Fund Crisis? Get Daily Money Tips to Your Inbox Email Address Sign Up. There was an error. Please enter a valid email address. Personal Finance Money Hacks Your Career Small Business Investing About Us Advertise Terms of Use Privacy Policy Careers Contact.