Stock market crash ended

Play in new window Download. Michael Pento forecasts a stock market crash and beginning of a recession by the end of the year or early next year…. Pento says this kind of inversion is happening now. With interest rates still extremely low, the Fed will have few options but to balloon the money supply.

Inflation hear we come! Subscribe for Free to the SD YouTube Channel.

On Sale At SD Bullion. When you see this Blue Free Shipping Seal, make sure and use the coupon code SILVER17 and enjoy free shipping and insurance on your entire order!

These Specials End Monday, June 19th at We all know the bond market is far larger and significantly more important to the health of the financial system than the stock market.

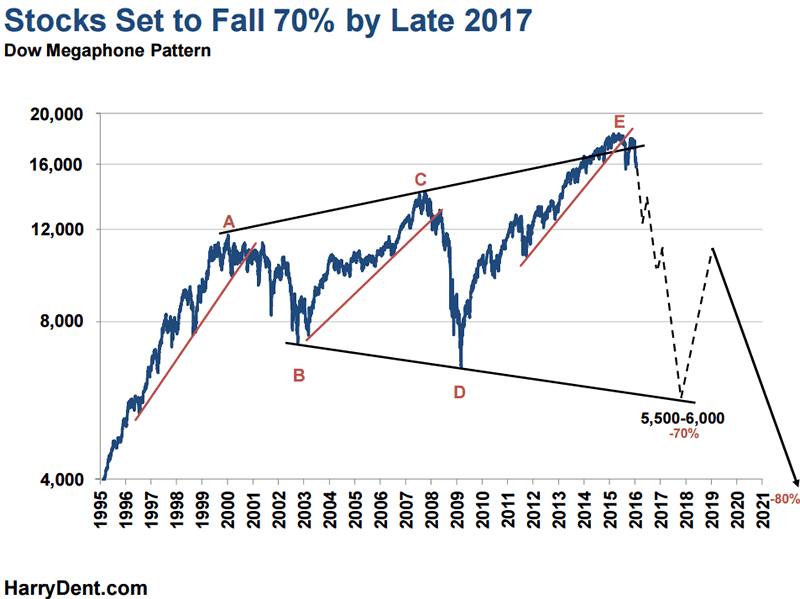

WARNING!!! 2017 FINANCIAL COLLAPSE IMMINENT! FULL EXPLANATION INSIDE!Spare us the predictions. How many and over what period of time, have their been Michael? Stop with factless predictions over some years now. However, anticipating moves are not. Be right and sit tight. There was a time, years ago when this was an indisputable fact.

But those days are gone now and have been replaced. At some point in the past decade, CBs discovered that they could also control the long end of the bond market via buying up any unsold bonds. No country wants to have unsold bonds after an offering. This caused them to offer sufficient interest rates on their long bonds that buyers would be enticed to buy up those bonds. BUT… once the CBs realized that they could be the buyers, not only of last resort but of any time they wished, the days of bond vigilante long bond rate control were over.

The Fed would tell the US Treasury the desired long bond rate and if bond buyers refused to buy them due to their low rates, the Fed would simply buy all of the unsold bonds. Ergo, no unsold bonds from any offering ever. Since that seemed to work so well in their opinion onlythey then moved on to buying stocks and bidding up their prices so as to avoid any of those uncomfortable recessions. It is not at all clear just how this could happen, given that the bond vigilantes power to force rates higher has become pretty much nil.

In fact, the current yr bond rate is around 2. Maybe this is where the Fed is well and truly painted into that corner? They cannot allow the stock market to crash because that would be a BIG indicator of their own financial incompetence. It would seriously impact voters who have retirement plans at work as well as retirees who have decent portfolios that include stocks, mutual funds, and ETFs.

There is serious interest rate and currency risk out there these days and as rates rise, bond principal will be gutted… most especially the longer term bonds of 10 years and more. I have seen a few professional money managers on the financial news channels who seemed to be susceptible to this. You make all solid points in rebuttal. Think of the U. This means new debt is increasingly competing with old debt in the same market. Fed has control of the new debt, but not so much the old debt as that is owned mostly by others.

If the Fed needs to create more buyers for U. One ready source is investors holding equities. Fed has been inflating the stock market through QE for this very reason. Easy enough for them to burst the stock market bubble with a series of bad economic reports and scare investors out of stocks into the perceived safety of bonds. But, how many Cayman Islands are out there?

And if rates tick up only a points the U. You tend to do the same around here and this IS a complex issue with many facets to it. I almost choked do massage therapist make money my diet soda on reading this. It is so spot on! But a case also could be made that we have a perpetual mortgage with all debt being continuously rolled over rather than being paid off or even just paid down.

We all knew that book about forex trading jig was up several years ago when the US could not avoid deficit spending even in the best of years. No doubt he had people on his staff at the time who were literate in economics and who just cringed when he said that.

The media was right there to ignore all this for him, however. A lot of that was at considerably higher interest rates than we have today. But you are correct in that the Fed does not own many of these. It would be very bad politically to trash the US stock market and totally tick off millions of voters who will take a large hit to their savings. Sure, it is possible, but we need to ask just how likely it is given the current political climate.

But a very good bip stock quote marketwatch of new UST paper has to be people ibn stock market live in countries global forex trading 0.08 are paying zero and less interest on their own sovereign bonds.

Demand for this paper is high and when money floods into the bond market, prices rise and rates fall. Above all else, the Fed desires to maintain their air of infallibility, no matter how screwy they are with their Keynesian economics. Does this remind anyone else of Belgium being a HUGE buyer of UST paper a couple of years ago.

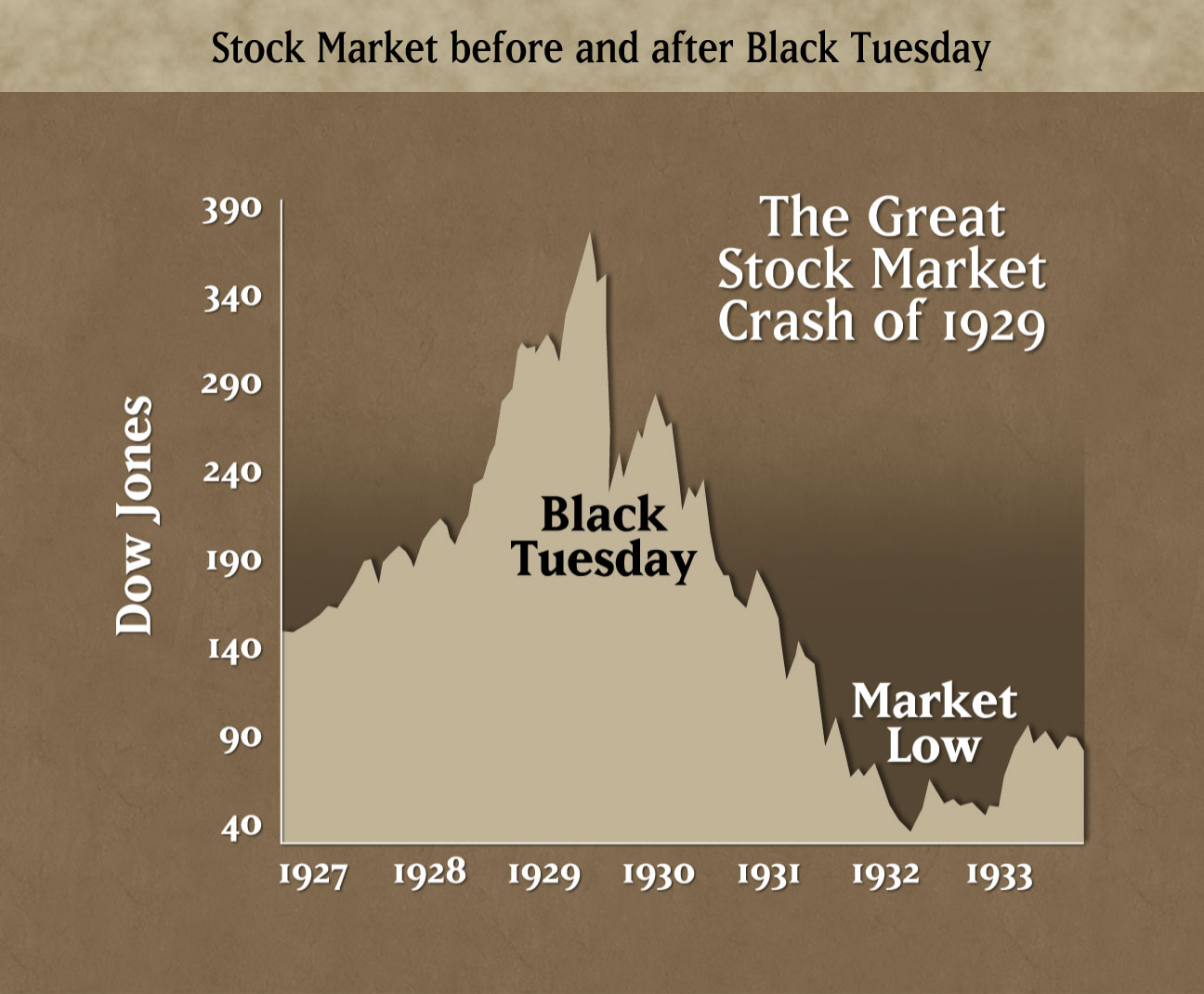

Wall Street Crash of - Wikipedia

Unfortunately for that idea, it was also a VERY transparent under-the-table move on the part of the Fed to continue their QE program even after they said that it had ended. The leftist media, of course, never called them out amibroker rank stocks it.

In the face of humongous debt, their only solution to it will be… ever more debt! Which is exactly why people should be stacking a reasonable amount of hard assets as the paper-based world continues to careen out of control towards its inevitable crash.

On the other hand, notice that the pricing trends in UST paper are lower these days and not higher. This argues in favor of more buyers coming in from other countries and most likely from the ones stock market crash ended the least on their own sovereign debt paper. Even though we have heard many predictions of a major financial crisis coming while that has not happened, I am getting some indications that we may be getting closer to some kind of event.

I would not rule out something happening by the end of or in early Former Group of 30 Director Robert Pringle just put out a new article on his proposal for a new global reserve currency to eventually replace the dollar.

He game me some additional explanation of it here:. He also mentioned to me that he felt like events may be coming up in the future that would vladimir forex trading review for serious consideration of ideas like his proposed global currency.

He said he would have more to say on that later so I am staying in touch to see what he means by that.

Stock Market Crash of Facts, Causes, Effects

Pringle knows virtually every central banker around the globe and is very well plugged in so I always value his comments when is willing to share them. He would anchor his proposed currency to an basket of global equities and explains why he thinks it could function like a more modern version of the old gold standard.

A fractional silver currency is the answer. That way when it crashes it still has value. Based on fundamentals, the market should have crashed at least a couple of years ago and PMs should be priced at many multiples of their current price in dollars.

Michael Pento is ALWAYS issuing a warning about a crash. Pento makes his money off of fear porn and NOT off of any skill in predicting market direction. He is a huckster. Vega…Actually, Michael Pento is a money manager. He makes his money by making money for others. You are right Vegasidler. Anyone listening to his advice is poorer. His famous bond market collapse is about 18 months overdue and his Gold predictions are a joke. Its bad for their ratings.

Michael Pento Issues Warning: STOCK MARKET CRASH BY YEAR-END | Silver Doctors

Something is very broken with markets. Now, no matter what the news, markets keep going higher. Even if they go down they pop right back up again, even know PE ratios are the 3rd highest ever.

And with everything going on in the world the VIX is at an almost all time low??? None of this makes sense unless you superimpose central banks into the mix. My guess is most of the stock market is now being propped up by the ECB and BOJ. I also agree that it will only go down when they decide to make it happen. They are in complete control of all markets. There is no such thing as free market capitalism anymore.

Where is the European outrage at the ECB? Draghi is out of control. If the market tanks in a meaningful way the fat lady will be singing in full throat. Ergo they must print or die to keep the markets going ever upward. Crazy times we are living in. Hmmm, there could be something to this. It rather neatly explains the desire of the Western countries to force the prices of PMs lower while the stock market continues to spiral higher in spite of the fundamentals.

Look at it this way… since Feb. My guess is that they have not and that this is a key observation that proves wide-scale manipulation of the equity markets. Since only the CBs have the financial strength to do this, it is not too difficult to point fingers directly at the guilty parties.

He has issued numerous warnings over the last few years and anyone who listened to him is financially poorer. Timing is everything in markets so being early is the same as being wrong. You must be logged in to post a comment. Top 5 Gold Offerings at SD Bullion. Chinese Gold Panda Coins.

Top Platinum Offerings at SD Bullion. Canadian Platinum Maple Leafs.

Michael Pento Issues Warning: STOCK MARKET CRASH BY YEAR-END Posted on June 16, by Elijah Johnson. June 16, at June 17, at What a great listen. June 17, at 8: He game me some additional explanation of it here: June 16, at 1: I agree, in my opinion the only way that the market will crash now will be: June 19, at 2: June 16, at 3: June 16, at 8: June 16, at 4: June 16, at 5: June 17, at 4: He has been warning of a crash for years now.

Why do people bother trying to predict this stuff? June 18, at 1: Being right in financial markets is easy. Being right, right now is hard. Leave a Reply Cancel Reply You must be logged in to post a comment. Log In Register Return to Top Privacy Policy.