Forex correlation arbitrage ea

Forex Million Pound Robot Price: ExtraEdge FX EA Price: ExtraEdge FX EA Review — Best Forex Expert Advisor For Long-Term Profits ExtraEdge FX E…. My Bitcoin Bot Price: XXL Forex Real Profit EA Price: AUDUSD, EURUSD, GBPUSD and USDCHF Timeframe: EverTech Forex Robot Price: AUDUSD, EURUSD and USDJPY Timeframe: FXMower EA Review — Accurate Forex Expert Advisor For Long-Term Profits FXMower E….

Any EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDCHF, EURGBP, EURCHF, EURAUD, AUDJPY, CADJPY, EURJPY, GBPJPY, NZDJPY and USDJ….

FX Secret EA Price: EURUSD, AUDUSD and USDJPY Timeframe: Easy Argo Scalper EA Price: FX Shutter Stock EA Price: AUDUSD, GBPUSD and EURCHF Timeframe: Signal Steps EA Price: EURUSD, GBPUSD and USDJPY Timeframe: Claudius Forex EA Price: Forex inControl EA Price: Inertia Trader EA Price: Arteon Forex Robot Price: EURUSD, GBPUSD, USDJPY, AUDUSD, EURGBP and USDCAD Timeframe: EURUSD, GBPUSD, AUDUSD, GBPJPY, USDJPY, EURAUD, GBPAUD, NZDUSD, AUDUSD, XAUUSD Gold Timeframe: EURUSD, GBPUSD, USDJPY and USDCHF Timeframe: EOS Forex EA Price: GBPUSD, USDCAD, USDCHF, EURGBP, EURCHF, GBPCAD, GBPAUD, EURAUD and AUDCAD Timeframe: Strike Fx EA Price: EURUSD, AUDUSD, NZDUSD, EURGBP, EURAUD, GBPCAD, GBPCHF and AUDNZD Timeframe: EURUSD, GBPUSD and USDCHF Timeframe: LIMITED DISCOUNT — USE COUPON CODE: CNNY — REGULAR PRICE: Fx Turbine EA Price: Fx Turbine EA Review — Profitable Forex Expert Advisor For Metatrader 4 Fx Turbine EA is ….

Modular Trader EA Price: AUDCAD, AUDUSD, AUDNZD, USDCAD, GBPUSD, EURUSD, EURNZD, EURJPY, NZDUSD, AUDJPY and XAUUSD Gold Timeframe: Funnel Trader EA Price: EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, EURJPY, GBPJPY, AUDJPY, NZDJPY Timeframe: EURUSD, AUDUSD, NZDUSD, USDCHF and USDJPY Timeframe: EURUSD, GBPUSD, NZDUSD, AUDCAD, AUDUSD, EURGBP, EURJPY, GBPCAD, GBPCHF and NZDCAD Timeframe: SPECIAL DISCOUNT FOR A SHORT TIME ONLY — REGULAR PRICE: Einstein Trader EA Price: New Forex Robot from the creator of the legendary Million Dollar Pips EA!

Einstein Trader EA Review — Bes…. WallStreet Forex Robot 2. EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, NZDUSD and AUDUSD Timeframe: Forex Real Profit EA Price: Happy Forex EA Price: EURUSD, EURCHF, GBPUSD and AUDUSD Timeframe: LIVE ACCOUNT TRADING RESULTS: GPS Forex Robot Price: EURUSD, GBPUSD, EURGBP and USDCHF Timeframe: GPS Forex Robot Review — A Profitable FX Expert Advisor For Metatrader 4 GPS Forex Robot is a very profit….

Forex Warrior EA Price: GBPUSD, EURUSD or EURGBP, and AUDUSD or NZDUSD Timeframe: ASA FX EA Price: Happy Market Hours EA Price: EURUSD, EURCHF, EURGBP, EURCAD, USDCAD, USDCHF, GBPUSD, GBPCAD, GBPCHF and CADCHF Timeframe: Happy Gold EA Price: LIVE ACCOUNT TRADING RESULTS:.

Easy Walker Fx EA Price: EURUSD, GBPUSD and EURGBP Timeframe: Easy Walker Fx EA Review — Accurate Night Scalper And Forex Expert Advisor Easy Walker Fx EA is a very powerful…. It is useful to know that some currencies tend to move in the same direction while others move in the opposite direction.

For those who want to trade more than one currency pair , this knowledge can be used to test strategies on correlated pairs, to avoid overexposure, to double profitable positions, to diversify risks, and to hedge. In the financial world, correlation is the statistical measure of the relationship between two securities or assets. There are a few websites out there that track the currency correlations between different pairs on different time frames and periods and present them in an easy to read table.

If you compare the two websites across a common time frame and period, such as daily period, you might see notable differences in how the two websites display correlation between pairs. For instance, on Aug 24, , I compared the Daily period correlation for EURUSD and AUDUSD, and there was a striking difference between the two websites: Perhaps they are using different correlation formulas behind the scenes, which makes it hard for the end user to determine the most accurate one.

Below is a screenshot of the hourly and daily correlations across leading pairs, using 50 period for each and taken on March 7, Reasons for strong correlation between EURUSD and GBPUSD:.

Interestingly enough, there are many pairs that move in the same direction as EURUSD and GBPUSD. EURUSD, GBPUSD, AUDUSD, NZDUSD, EURJPY, AUDJPY and NZDJPY usually move in the same overall direction.

However, the amplitude and pattern they make while moving in the same direction can be somewhat different. Here is all the above pairs side by side from , covering three directional movements, a steady rise a sudden fall second half of 08 and strong recovery Notice that in all three up and down movements over that 4 year period all the pairs shared the same direction, albeit with different amplitudes.

The EURJPY rose the highest from , the GBPJPY fell the hardest in the second half of , and the AUDUSD and NZDUSD made the best recovery in These pairs tend to move in mirror opposite directions. While the two pairs are moderately correlated on the weekly horizon, they are very strongly correlated at Check out the mirror relationship between the two pairs during the up , down second half 08 , up period between Reasons for strong negative correlation between EURUSD and USDCHF:.

Interestingly enough, there are many pairs that move in the same direction as the USDCHF, particularly when they have USD as the first currency quoted.

Notice how all these pairs move in lockstep from until the crisis unfolds, and then the Dollar explodes in strength, sending all the pairs upwards with differing degrees of force. One of the best ways to test a strategy for robustness is to see if its back and forward tested results can be duplicated across correlated pairs.

Most people at this point would get overexcited and itch to trade their newly minted EA. One way to to discover if your optimized parameters are more true to the markets is to backtest these parameters on different historical periods of the same pair, and the same and different historical periods of correlated pairs. For instance, if you discover that your EA has promising back tests on EURUSD for the last two years from , try to backtest that same EA on the years of , and on correlated pairs like GBPUSD and AUDUSD and USDCHF on all four years.

Ninety percent of the time your newly minted EA will simply not work on outside years and pairs and you have to face the fact that you may have over-optimized your EA to the one pair for those last two years. However, sometimes you may get the real Eureka moment when your EA does indeed perform reasonably well on different historical periods and pairs.

When that happens you have may go to set your EA up on demo and real accounts with a whole lot more confidence. There might be times when you have discovered or created awesome strategies that back test well on the four currencies EURUSD, GBPUSD, AUDUSD, USDCHF.

You might be tempted to trade all your new found strategies thinking that, because they are worked out on different currency pairs, you are diversified. You know that you should be using 2: There is nothing wrong with doing this, if you have incredible confidence in the performance of each strategy and in the possibility of surviving an aggregate draw down.

About | Sift Media

With aggregate draw down, you add the max draw down of the four pairs. Because of the strong correlation between all four, you are basically magnifying your draw down by a factor of 4 in the future. I can tell you from hard experience that if you are creating trend based strategies on different pairs, they will have their draw down at roughly the same time, usually during a prolonged sideways, volatile market the bane of all trend strategies.

This is the cup half full side to the cup half empty rule above. You are looking to double position size by placing your orders on currency pairs trending in the same direction.

Why would you want to this? Well, though the draw down can be doubled, so too can the profit.

Currency Pair Correlations - Best Forex EA's | Expert Advisors | FX Robots

Moreover, the risk side can be somewhat reduced by moving into an alternate currency pair, versus doubling on the same. You would be increasing profit potential at the same time you would be spreading out your risk. Moreover, oftentimes pairs are subject to sudden jumps in price that seem to get you out at your stops or lure your into false trades. Different monetary policies of central banks have differing impacts on the correlated pairs, such as that one might be less affected than the other or move steadier with less volatility.

While knowing that EURUSD and USDCHF move inversely, there is no point going short both positions at the same time because eventually they cancel each other, for when EURUSD falls, USDCHF rallies. It is almost like you had virtually no positions, except for the fact that you paid spread or commission on both trades, without the potential to profit. If one is trading with EA 1 on EURUSD, and EA 2 on USDCHF, it is quite possibility that EA 1 will be short the EURUSD at the same time that EA 2 is short the USDCHF.

It is also conceivable that the timing of the entry and exit of each EA is different enough that both come out with profit. Or one comes out with profit, the other with loss. If I had properly back tested both EAs and thought there were compliments to one another, I would not worry about the coincidental hedge issue.

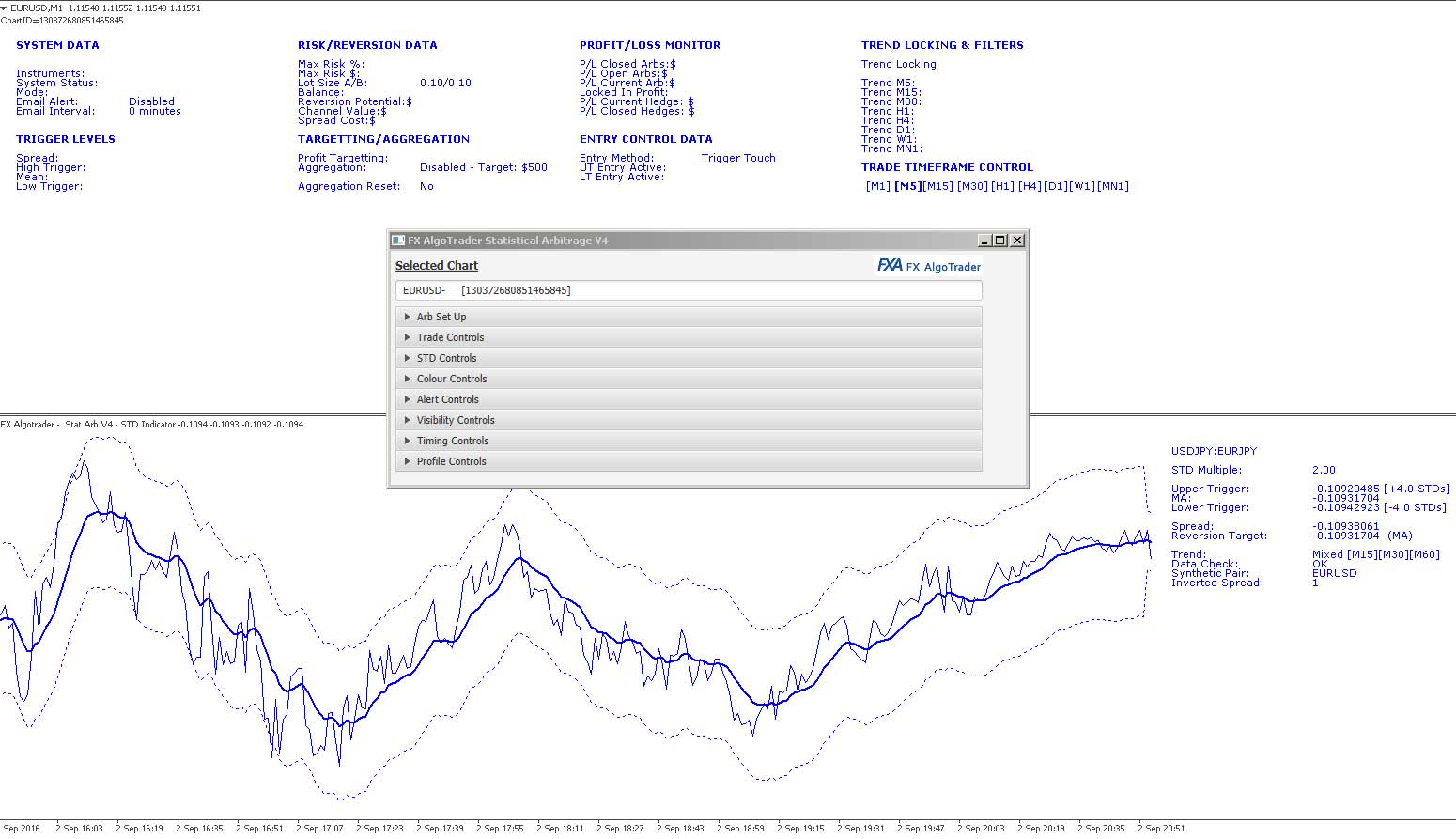

Some people like to lock in full hedges with correlated pairs when they have seen these pairs deviate beyond their normal ranges. For instance, if you see that the GBPUSD has entered the overbought zone of a RSI or Stochastics, while at the same time the EURUSD is in the oversold zone of a H4 or D1 time frame, one can see this as an interesting scenario to go short GBPUSD and long EURUSD, with the hope that the pairs will revert back to their normal range and you can eventually profit when they do.

While this strategy looks interesting at first glance, it is very risky. There is really no standard range that these two pairs are forced to exist within, and at times they may move inversely away from each other with great force.

You would be severely punished to be the opposite side of such a move. My combination did well for time up till August , when all the currencies started to fall against the dollar the dollar as safe haven in time of financial crisis and panic , then I realized that my strong dollar strategies long USDCHF were not as equally weighted to my weak dollar long EURUSD strategies as I had thought.

BJF Forex Latency Arbitrage EA Review - Best One-Leg Arbitrage FX Expert AdvisorI noticed that my long EURUSD strategies kept getting triggered, even on the descent, and there were few long USDCHF that were being brought into play to offset the damage. In hindsight, I would have been better off just trading stop and reverse trending systems on EURUSD, so that when the systems picked upon the long downward trend, it would have fully ridden it down.

Government Required Disclaimer — Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Information contained within this course is not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice.

SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. We accept no liability whatsoever for any direct or consequential loss arising from the use of this product. All original content on https: Reproduction or re-publication of this content is prohibited without permission.

WordPress Business Press Pro Theme. Displays 4 correlation tables each working on a separate time frame: Moving mouse cursor over any cell within the table produces a small correlation chart of two pairs over the selected period. Compares selected pair against 29 other pairs all at once on one of 5 selected time frames 5, 15, 30, hourly, 5 hours, daily and one of 6 selected periods 10,25,50,,, , ranking pairs from highest to lowest correlation.

Also displays two correlating pair charts to the one selected, so that you can see with your own eyes how the three charts look similar.