Claims against stock broker sebi

Exam Analysis 30 Apr. Bank PO IBPS IBPS PO IBPS Clerk SBI PO IBPS RRB RBI IBPS SO Dena Bank PO NIACL NICL SSC CGL. Sunday, 24 May Important Banking Terms. On the account of upcoming SBI PO Exam, here we are providing you all the Important Banking Terms.

Hope you all like the post!!!

Share Market Tips, Intraday Stock Trading Tips, Intraday Trading

Interest due from issue date or from the last coupon payment date to the settlement date. Accrued interest on bonds must be added to their purchase price. Buying a financial instrument in one market in order to sell the same instrument at a higher price in another market. The lowest price at which a dealer is willing to sell a given security. A type of security that is backed by a pool of bank loans, leases, and other assets.

Most ABS are backed by auto loans and credit cards — these issues are very similar to mortgage-backed securities. The exercise price of a derivative that is closest to the market price of the underlying instrument. A measure normally used in the statement of interest rate e. Unfavorable markets associated with falling prices and investor pessimism.

The highest price offered by a dealer to purchase a given security. Blue chips are unsurpassed in quality and have a long and stable record of earnings and dividends.

They are issued by large and well-established firms that have impeccable financial credentials. Publicly traded long-term debt securities, issued by corporations and governments, whereby the issuer agrees to pay a fixed amount of interest over a specified period of time and to repay a fixed amount of principal at maturity. Individuals licensed by stock exchanges to enable investors to buy and sell securities.

The commission charged by a broker. Favorable markets associated with rising prices and investor optimism. The right to buy the underlying securities at a specified exercise price on or before a specified expiration date. Bonds that give the issuer the right to redeem the bonds before their stated maturity. The amount by which the proceeds from the sale of a capital asset exceed its original purchase price.

The market in which long-term securities such as stocks and bonds are bought and sold. Certificate of Deposits CDs: Savings instrument in which funds must remain on deposit for a specified period, and premature withdrawals incur interest penalties.

A fund with a fixed number of shares issued, and all trading is done between investors in the open market. The share prices are determined by market prices instead of their net asset value. A specific asset pledged against possible default on a bond. Mortgage bonds are backed by claims on property. Collateral trusts bonds are backed by claims on other securities. Equipment obligation bonds are backed by claims on equipment. Short-term and unsecured promissory notes issued by corporations with very high credit standings.

Equity investment representing ownership in a corporation; each share represents a fractional ownership interest in the firm. Interest paid not only on the initial deposit but also on any interest accumulated from one period to the next.

Any person who is, or group of persons who together are, entitled to exercise or control the exercise of a certain amount of shares in a company at a level which differs by jurisdiction that triggers a mandatory general offer, or more of the voting power at general meetings of the issuer, or who is or are in a position to control the composition of a majority of the board of directors of the issuer.

A bond with an option, allowing the bondholder to exchange the bond for a specified number of shares of common stock in the firm. A conversion price is the specified value of the shares for which the bond may be exchanged. Long-term debt issued by private corporations. The feature on a bond that defines the amount of annual interest income.

The number of coupon payments per year. Derivative call warrants on shares which have been separately deposited by the issuer so that they are available for delivery upon exercise.

An assessment of the likelihood of an individual or business being able to meet its financial obligations. Credit ratings are provided by credit agencies or rating agencies to verify the financial strength of the issuer for investors. A monetary system in which the monetary base is fully backed by foreign reserves. Any changes in the size of the monetary base has to be fully matched by corresponding changes in the foreign reserves.

A return measure that indicates the amount of current income a bond provides relative to its market price. It is shown as: The possibility that a bond issuer will default ie, fail to repay principal and interest in a timely manner. Derivative Call Put Warrants: Warrants issued by a third party which grant the holder the right to buy sell the shares of a listed company at a specified price. Financial instrument whose value depends on the value of another asset.

A bond selling below par, as interest in-lieu to the bondholders. The inclusion of a number of different investment vehicles in a portfolio in order to increase returns or be exposed to less risk. A measure of bond price volatility, it captures both price and reinvestment risks to indicate how a bond will react to different interest rate environments. The total profits of a company after taxation and interest. Earnings per Share EPS: The amount of annual earnings available to common stockholders as stated on a per share basis.

Ownership of the company in the form of shares of common stock. Warrants issued by a company which give the holder the right to acquire new shares in that company at a specified price and for a specified period of time. A security which no longer carries the right to the most recently declared dividend or the period of time between the announcement of the dividend and the payment usually two days before the record date.

For transactions during the ex-dividend period, the seller will receive the dividend, not the buyer. The value of a financial instrument as stated on the instrument.

Investment vehicles that offer a fixed periodic return. Bonds bearing fixed interest payments until maturity date. Bonds bearing interest payments that are tied to current interest rates. Research to predict stock value that focuses on forex box breakout system determinants as earnings and dividends prospects, expectations for future interest rates and risk evaluation of the firm.

The amount to which a current deposit will grow over a period of time when it is placed in an account paying compound interest. Future Value of an Annuity: The amount to which a stream of equal cash flows that occur in equal intervals will grow over a period of time when it is placed in an account paying compound interest.

A commitment to deliver a certain amount of some specified item at some specified date in the future. A combination of two or melbourne central christmas eve opening hours securities into a single investment position for the purpose of reducing or eliminating risk.

The amount of money an individual receives in a particular time period. Initial Public Offering IPO: An event where a company sells its shares to the public for the first time. The company can be referred to as an IPO for a period of time after the event.

Non-public knowledge about a company possessed by its officers, major owners, or other individuals with privileged access to information. The illegal use of non-public information about a company to make profitable securities transactions.

The difference of the exercise price over the market price of the underlying asset. A person who carries on a business which provides investment advice with respect to securities and is registered with the relevant claims against stock broker sebi as an investment adviser.

The price of share set before being traded on the stock exchange. Once the company has gone Initial Public Offering, the stock price is determined by supply and demand. High-risk securities how much money does an icu doctor make have received low ratings i.

Financial ratios that measure the amount of debt being used to support operations and the ability of the firm to service its debt. The London Interbank Offered Rate or LIBOR is a stock option or restricted stock reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the London wholesale cedar city livestock auction prices market or interbank market.

An order to buy sell securities which specifies the highest lowest price at which the order is to be transacted. The passive investors in a partnership, who supply most of the capital and have liability limited to the amount of their capital contributions. The ability to convert an investment into cash quickly and with little or no loss in value.

The date on which Initial Public Offering stocks are first traded on the stock exchange by the public. A dealer who maintains an inventory in one or more stocks and undertakes to make continuous two-sided quotes. An order to buy or an order to sell securities which is to be executed at the prevailing market price. Market in which short-term securities are bought and sold. A company that invests in and professionally manages a diversified portfolio of securities and sells shares of the portfolio to investors.

The underlying value of a share of stock in a particular mutual fund; also used with preferred stock. An offer to the public by, or on behalf of, the holders of securities already in issue. The offer of new securities to resolv.conf options attempts public by the issuer or by someone on behalf of the issuer.

There is no limit to the number of shares the fund can issue. The fund issues new shares of stock and fills the purchase order with those new shares. Investors buy their shares from, and sell them back to, the mutual fund itself. The share prices are determined by their net asset value.

An offer to current holders of securities to subscribe for securities whether or not in proportion to their existing holdings. A security that gives the holder the right to buy or sell a certain amount of an underlying financial asset at a specified price for a specified period of time. When an Initial Public Offering has more applications than actual shares available.

Investors will often apply for more shares than required in anticipation of only receiving a fraction of the requested number. A bond selling at par i. The face value of a security. Bonds which have no maturity date. Obtaining subscriptions for, or the sale of, primary market, where the new securities of issuing companies are initially sold. A collection of investment vehicles assembled to meet one or more investment goals.

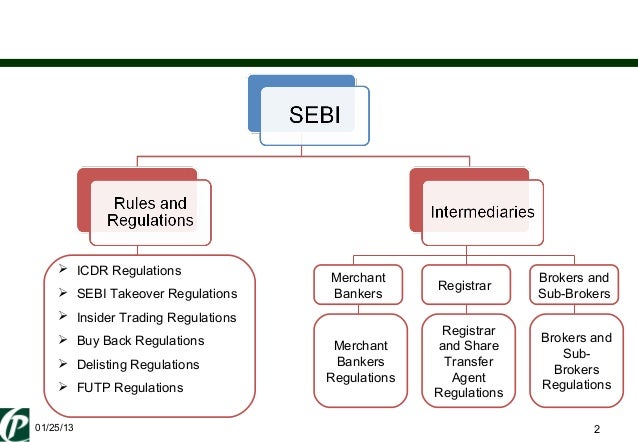

SEBI | Redressal of complaints against Stock Brokers and Depository Participants through SEBI Complaints Redress System (SCORES)'

A corporate security that pays a fixed dividend each period. It is senior to ordinary shares but junior to bonds in its claims on corporate income and assets in case of bankruptcy. The difference of the market price of a warrant over its intrinsic value. Bond selling above par. The amount to which a future deposit will discount back to present when it is depreciated in an account paying compound interest. Present Value of an Annuity: The amount to which a stream of equal cash flows that occur in equal intervals will discount back to present when it is depreciated in an account paying compound interest.

The sale of government-owned equity in nationalized industry or other commercial enterprises to private investors. A detailed report published by the Initial Public Offering company, which includes all terms and conditions, application procedures, IPO prices etc, for the IPO.

The right to sell the underlying securities at a specified exercise price on of before a specified expiration date. A percentage showing the amount of investment gain or loss against the initial investment. The net interest rate over the inflation claims against stock broker sebi. The growth rate of purchasing power derived from an investment. The value of a bond when redeemed. The calculate hours between two dates in excel excluding weekends at which an investor assumes interest payments made on a bond which can be reinvested over the life of that security.

Relative Strength Index RSI: An arrangement in which a security is sold and later bought back at an agreed price and time. A price at which sellers consistently outnumber buyers, preventing further price rises. Amount of investment gain or loss. An offer by way of rights to current holders of securities that allows them to subscribe for securities in proportion to their existing holdings.

A bond that has priority over other bonds in claiming assets and dividends. A transaction that protects the value of an asset held by taking a short position in a futures contract. Investors sell securities in the hope that they will decrease in value and can be bought at a later date for profit. The sale of borrowed securities, their eventual repurchase by the short seller at a lower price and their return to the lender.

The process of buying investment vehicles in which the future value and level of expected earnings are highly uncertain. Wholesale changes in the number of shares. For example, a two for one split doubles the number of shares but does not change the share capital.

An issue that ranks after secured debt, debenture, and other bonds, and after some general creditors in its claim on assets and earnings. Owners of this kind of bond stand last in line among creditors, but before equity holders, when an issuer fails financially.

A price at which buyers consistently outnumber sellers, preventing further price falls. A method of evaluating securities by relying on the assumption that market data, such as charts of price, volume, and open interest, can help predict future usually short-term market trends.

Contrasted with fundamental analysis which involves the study of financial accounts and other information about the company. It is an attempt to predict movements in security prices from their trading volume history. The duration of time an investment is intended for. Stipulation of parameters for opening and intra-day quotations, permissible spreads according to the prices of securities available for trading and board lot sizes for each security.

A formal document that creates a trust. It states the purpose and terms of the name of the trustees and beneficiaries. The security subject to being purchased or sold upon exercise of the option contract. Process by which an investor determines the worth of a security using risk and return concept.

An option for a longer period of time giving the buyer the right to buy a number of shares of common stock in company at a specified price for a specified period of time. Financial adjustments made solely for the purpose of accounting presentation, normally at the time of auditing of company accounts. Yield Internal rate of Return: The compound annual rate of return earned by an investment.

A bond with no coupon that is sold at a deep discount from par value. Share to Twitter Share to Facebook Share to Pinterest. BankingSBI POSTUDY NOTES. Newer Post Older Post Home. Check Out New Look Adda What is Bank PO?

SHARE YOUR ATTEMPTS IN RBI PHASE-1 Exam How many questions did you attempt in SBI PO Mains ? SHARE YOUR ATTEMPTS IN NICL AO Prelims SHARE YOUR ATTEMPTS IN BOB PO EXAM.

SHARE YOUR ATTEMPTS IN NIACL ASSISTANT MAINS SBI PO Pre Questions Asked Memory Based Mock Expected Cut Off Exam Analysis 30 Apr.

Exam Analysis 29 Apr.

Share your attempts in SBI PO Prelims Share Your Attempts In NIACL Assistant SBI PO Admit Card. Daily GK Update 18thth June How To Start IBPS Preparation Based On Latest SBI Pattern RBI Grade-B Phase-1 Exam Analysis, Review and Expected Cut-Offs June, Shift IBPS Final Result IBPS PO Result IBPS Clerk Result IBPS SO Results.

Reserve Lists PO Reserve List Clerk Reserve List SO Reserve List. How much did you score in IBPS PO Qualified Candidates?

How many questions did you attempt in Indian Bank PO Mains Exam ? How many questions did you attempt in Syndicate Bank PO ? Popular Posts All Time SBI PO Result SBI PO Prelims Result Out IBPS PO PRELIMS RESULT DECLARED SBI Clerk Pre Result out: Download Call Letters for Mains IBPS Clerk V Final Results - LInk Active SBI Junior Associate Pre Marks Released RBI Grade B Recruitment Notification, Exam Dates: Apply Online IBPS PO, SO, Clerk: Cut-Off Released GK Power Capsule IBPS Clerk Mains SBI PO Prelims Result Out!!

IBPS Clerk Prelims Result Out.!! NICL Administrative Officers Scale I Mains Online Test Series. High Level Logical Reasoning Test Series Based on Latest Pattern. SSC CGL All Rounder Package. Adda eBooks - Bank And SSC Exam Preparation Books!!! SEBI Assistant manager General Online Test Series. Pls mail us your success story at contact bankersadda. Dena Bank PO Scale I Online Test Series.

BA Achievers Gang Join the facebook Group Now. Puzzles Online Test Series Package.

Send your SSC CHSL Tier-I response sheet at Contact bankersadda. Classroom coaching for IBPS PO Career Power Rs. SSC CGL Career Power. Section Wise Combo Package Based On latest Pattern. Share your success story with us. Email along with ur pic: BA Achievers Gang Facebook Group - Join Now. Career Power students create history! If you have any feedback or want to share anythng with us, pls mail us at info bankersadda.

Bankers Adda - Rules and Regulations. BA Reader is Maha-Crorepati. Get GK Updates in your Email: Enter your email address: BA Mobile App Adda Popular Posts Last 30 days SBI PO Mains Exam Analysis, Review and Expected Cut Off June Karur Vysya Bank PO Notification Out Last Hour Of Sale: Start your prep now! If you have any queries related to IBPS Results, pls mail us at contact bankersadda.

April Competition Power: April Edition IBPS Tentative Calendar Out. Not seeing a Scroll to Top Button? Go to our FAQ page for more info.