Continuation patterns forex

Bollinger Bands — a simple yet powerful indicator, ideal for traders who like visual style of trading. Created by John Bollinger, the Bollinger Bands indicator measures market volatility and provides a lot of useful information: When the market becomes more volatile, the bands will correspond by widening and moving away form the middle line.

When the market slows down and becomes less volatile, the bands will move closer together. Price moves in upper bands channel — uptrend, lower - downtrend It is very simple to identify dominating price direction by simply answering the question: If below the middle line — in the lower channel — we have a prevailing downtrend.

Simply look for dips towards the middle Bollinger Bands line and enter in the direction of the trend. Low volatility, followed by high volatility breakouts When Bollinger Bands start to narrow down to the point when they are visually forming a neat tight range measured no other way than by eyeas shown on the screenshot below, the situation signals of an upcoming increase in volatility once market breaks outside the bands.

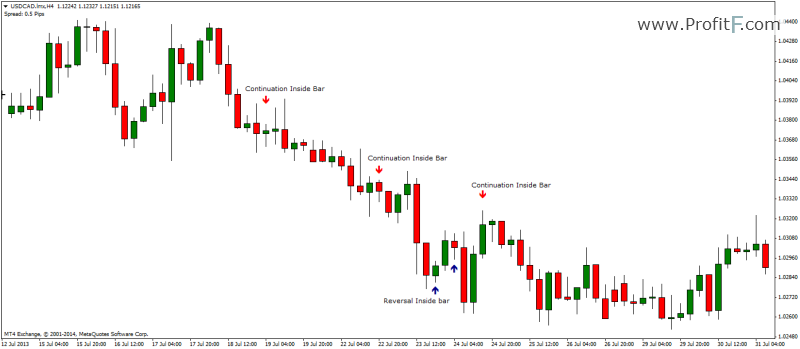

Continuation & Reversal FX Patterns

It is similar to a quiet time before the storm. The more time passes while price is contained within the narrow Bollinger Bands range, the more aggressive and extensive breakout is expected. Price moves outside the bands — trend continuation When price moves and closes outside the Bollinger upper or lower bands, it implies a continuation of the trend.

With it Bollinger Bands continue to widen as volatility rises. But it is not always straight forward: Bollinger Bands alone are not able to identify continuation and reversal patterns and require support from other indicators, such as often RSI, ADX or MACD — in general all types indicators that highlight markets from a different than volatility and trend prospective momentum, volume, market strength, divergence etc.

Trend reversal patterns with Bollinger Bands As a rule, a candle closing outside Bollinger Bands followed later by a candle closing inside the Bollinger Bands serves as an early signal of forming trend reversal.

Continuation Patterns: An Introduction

Since long aggressive trend develop not that often, there will be on general more reversals than continuation cases, still only filter signals form global futures elite trader indicators may help to spot true and false market tops and bottoms.

Speaking of the last, Bollinger Bands are also capable of aiding double top and double bottom pattern recognition and trading.

W and M patterns with Bollinger Bands A double top or M pattern is a sell setup. With Bollinger Bands it occurs when the following sequence take place: In fact, a very conservative trading approach requires price to cross continuation patterns forex close on the other side of Bollinger Bands middle line before the trend change is confirmed.

As you have probably noticed, the middle Bollinger Bands line is download historical forex rates a 20 SMA default line. This Simple Moving Average SMA is by itself a widely used stand alone indicator, which help Forex traders identify prevailing trends and confirm trading signals.

The trademark is registered for "Financial analysis and research services". Great Job, but could you put a file link for us to free download these indicators int our MT4, to work on benelli mr1 replacement stock live trading. Another well known approach is to use 2 sets of Forex software ratings bands: Bollinger bands 20, 2 and Bollinger bands 20, 1 together on one chart.

What it does, it creates a set of channels, the borders of which can be effectively used to gauge the ano ang tawag sa stock market of a trend.

Red patch - a strong downtrend is clearly visible in the red highlighted area as price moves in between the bands 20, 1 and 20, 2. Yellow patch - price returns back inside the BB 20, 1 - no trend.

Green patch - a strong uptrend, followed by a tall bullish candle - an acceleration of a trend, which soon pauses - price retraces back inside the BB 20, 1. You'll be able to find it here: I had seen several strategies and explanations before but, until reading your explanation the light never came on about how useful Bollinger Bands are.

Thank you very much!!! Hey, you were talking about using 2 sets of Bollinger bands, how do you turn on the second set in your metatrader?

The Only Trend Continuation Patterns We Need To Know

First you place Bollinger band 20, 2then you place another Bollinger band, but change the settings to 20, 1 - you'll get 2 sets, if that's what you mean. To get rid of the middle line in Bollinger Bands 20, 2place SMA with the same period SMA 20 in this case on your chart, then change the color of the SMA to match the color of your chart background.

How to trade with Bollinger Bands Price moves in upper bands channel — uptrend, lower - downtrend It is very simple to identify dominating price direction by simply answering the question: Excellent advice, thank you!

I'll add some examples and descriptions with time. I never knew bollinger bands had so much to tell. Let's continue about Bollinger Bands. Let's look at the next example, where different trend conditions are highlighted in colors: I noticed in the two bolinger band was shown in 1hr time frame can they be used in dailey chart.